Trade unions back Somalia's new sales tax, say it's the right step towards fiscal transparency

By Abdirahman Khalif |

The sales tax, which came into effect on August 18, 2024, is viewed by the Federation of Somali Trade Unions as a key development in modernising Somalia's tax collection system.

The Federation of Somali Trade Unions (FESTU) has voiced strong support for the Somali government's newly implemented 5 per cent sales tax, emphasising its importance for fiscal transparency and national progress.

The sales tax, which came into effect on August 18, 2024, is viewed by FESTU as a key development in modernising Somalia's tax collection system. Representing over 173,000 workers across 12 affiliated unions, FESTU has described this tax as a significant step toward ensuring that government revenues are directly channelled into the National Treasury, avoiding intermediaries and enhancing accountability.

Keep reading

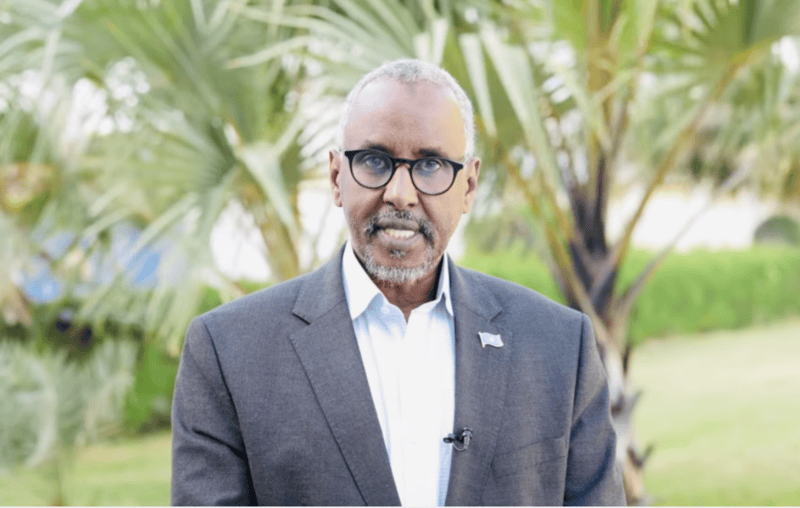

Omar Faruk Osman, General Secretary of FESTU, emphasised the critical role of a robust taxation system in building a relationship of accountability between citizens and the government.

According to Omar, the sales tax is essential to the functioning of state institutions and the provision of vital services such as healthcare, education, and security. He stated that every payment made by the public through this tax should serve its intended purpose in fostering national development.

"A robust taxation system fosters a contract of accountability between the citizens and the government, ensuring that every payment made by the public serves its intended purpose in national development," said Omar.

The implementation of the sales tax has a historical background. It was first proposed in 1984, with a reattempt in 2018. However, both efforts failed due to inefficiencies and a lack of transparency, which eroded public trust and hindered effective revenue collection.

Mogadishu's largest Market Bakaro closed for a second day as traders protest against new 5% sales tax imposed by the Ministry of Finance. pic.twitter.com/7ZrIqGJKJt

— The Eastleigh Voice (@Eastleighvoice) August 19, 2024

The current attempt, under the 2024 Appropriation Budget Act, seeks to overcome these past challenges by expanding the scope of the tax and mandating that all contributions go directly to the national treasury. This measure is seen as a way to avoid bureaucratic delays and potential mismanagement.

While FESTU has expressed full support for the tax, it has sparked significant controversy, particularly in the Jubbaland region. The state Ministry of Finance in Jubbaland has rejected the federal government's decision to impose the sales tax on businesses in the region.

Jubbaland authorities argue that the decision was made without proper consultation or consent. In response, they have advised local businesses to disregard the federal mandate and continue operating under the region's own tax laws, which were established in 2023.

This defiance highlights the ongoing tension between regional and federal authorities in Somalia and raises concerns about the effective implementation of the tax, as well as its potential to deepen existing political divides.

The controversy over the tax has not been limited to Jubbaland. In Mogadishu, the new policy has led to widespread protests, particularly among Bajaj (tuk-tuk) drivers. The drivers argue that the tax imposes an additional financial burden on their already strained livelihoods.

In response to these developments, a group of Somali Members of Parliament (MPs) has formally requested that the Speaker of Parliament include public grievances about the tax in the parliamentary agenda. The MPs have cited Article 25, Paragraph 3, Section "d" of the parliamentary bylaws to stress the urgency of holding a debate to address the concerns of businesses and citizens alike.

Moreover, there are broader concerns that the automatic deduction of the sales tax could place a significant financial strain on businesses, particularly those without access to formal banking services. These issues could complicate the tax's implementation, making it crucial for the government to address these challenges to ensure the policy's success and gain public acceptance.

Reader comments

Follow Us and Stay Connected!

We'd love for you to join our community and stay updated with our latest stories and updates. Follow us on our social media channels and be part of the conversation!

Let's stay connected and keep the dialogue going!